- SCALABLE

- Posts

- 📈 VC Term Sheet Guide

📈 VC Term Sheet Guide

👉 I'm sharing one of the biggest VC reports of 2025.

👋 Hey — Egemen here.

Big drop this week.

I found one of the best VC reports of 2025 and pulled out the key stuff.

I pulled out the good stuff so you don’t have to.

Early-stage deals are heating up, late-stage terms are getting tighter, and international money is everywhere.

Here’s a snapshot of what’s on the menu today:

💡 Spotlight: Wati.io

🧠 Deep-Dive: Venture Capital Term Sheet Guide

🗺️ Method: Investor CRM Template

⚾️ Catch: AI in 5 Minutes

☝️ Scaled This Past Week: re:cap

💡 Spotlight: Wati.io

Use WhatsApp to chat with customers, send updates, and handle support all in one place.

You can build chatbots, automate replies, and send bulk messages without needing to code.

It’s built for teams so you get shared inboxes, CRM integrations, and performance tracking to keep everyone in sync.

🧠 Deep-Dive: Venture Capital Term Sheet Guide

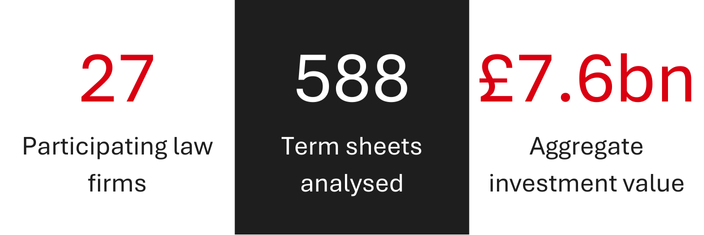

I came across the VC Term Sheet Guide by HSBC Innovation lately.

It’s a whopping 91 pages, and a banger of a report, worth a read if you have the time.

Here are 3 key insights:

Well, seed investing is heating up.

More international and experienced investors are jumping into early-stage deals. It’s getting super competitive, and founders are getting better terms with less red tape.

Later-stage investors are taking more risks

Bigger rounds are still happening, but usually at lower valuations. These deals tend to be more structured, giving investors more protection if things go south.

Scaling up is still tough in the UK

UK investors lead most early rounds (70%), but when it comes to bigger, later-stage deals, international investors are taking over, up from just over half to around 80% in the past year.

beehiiv 🐝 | refind 🌀 |

🗺️ Method: Investor CRM Template

It’s probably impossible to remember all the prospective investors you speak to, let alone details of when you last spoke, what you talked about, etc.

That is why you need an investor CRM tracker that keeps all your contacts in one place.

(PS: All templates are 100% free for lifetime members.)

⚾️ Catch

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

☝️ Scaled This Past Week: re:cap

re:cap just secured 125M EUR – it’s the scale of the week!

Founders and CFOs now face challenges in funding and managing growth amid rising interest rates, valuation pressures, and heightened investor scrutiny, re:cap is here to save’em!

Here’s what they do:

offer flexible, non-dilutive debt funding to tech companies, and

provide real-time capital planning and liquidity management tools.

Reply