- SCALABLE

- Posts

- 📊 SaaS Trends for 2026

📊 SaaS Trends for 2026

👉 The SaaS market can still grow while individual products lose. I break down what consolidation really means for founders in 2026.

👋 Hey — Egemen here.

SaaS budgets aren’t expanding by default anymore.

Buyers are consolidating, scrutinizing harder, and choosing tools that reduce friction.

This week, I’m sharing the summary of a fantastic report I read about SaaS trends that actually matter for product and GTM this year.

Here’s a snapshot of what’s on the menu today:

💡 Spotlight: Free payroll toolkit

🧠 Deep-Dive: 2026 SaaS Trends

🗺️ Method: How your competitors win at AI

⚾️ Catch: Better newsletter ads

☝️ Scaled This Past Week: Deepgram

💡 Spotlight

Payroll errors cost more than you think

While many businesses are solving problems at lightspeed, their payroll systems seem to stay stuck in the past. Deel's free Payroll Toolkit shows you what's actually changing in payroll this year, which problems hit first, and how to fix them before they cost you. Because new compliance rules, AI automation, and multi-country remote teams are all colliding at once.

Check out the free Deel Payroll Toolkit today and get a step-by-step roadmap to modernize operations, reduce manual work, and build a payroll strategy that scales with confidence.

🧠 Deep-Dive: 2026 SaaS Trends

A lot of founders still build and sell as if software budgets only expand.

What I keep seeing now is a different buyer posture: more scrutiny, slower decisions, and active consolidation.

Vena’s 2026 SaaS benchmarks roundup framed it well, noting longer evaluation cycles and greater efforts to consolidate tech stacks as companies pay closer attention to SaaS spending.

The chart above is useful context. The SaaS market can still grow rapidly at a macro level, but that does not mean any given product gets a free pass into the stack.

It’s effectively becoming a bigger market with tougher shelf space.

In a consolidation cycle, winning is less about novelty and more about reducing friction for the buyer. One stat I like to keep front and center: buyers rank integrations as their #3 priority when evaluating new software, behind security (#1) and ease of use (#2).

That is a simple roadmap filter for both product and go-to-market. Not to my surprise, product-led strategies will come up on top.

Speed matters too because it shows up directly in revenue. Vena highlights that a one-second delay in mobile page load time can drive a 26% drop in conversions.

I always say UX is not a “nice to have'“, it’s a pipeline variable.

If you want to translate these into execution, I’d push three actions:

Sell the “replacement story” clearly: what gets removed, what gets consolidated, what risk goes down.

Put integrations in the demo flow, not in the appendix, and align them to the buyer’s current tools.

Treat performance as a revenue metric, with a shared target owned by product and growth.

🗺️ Method

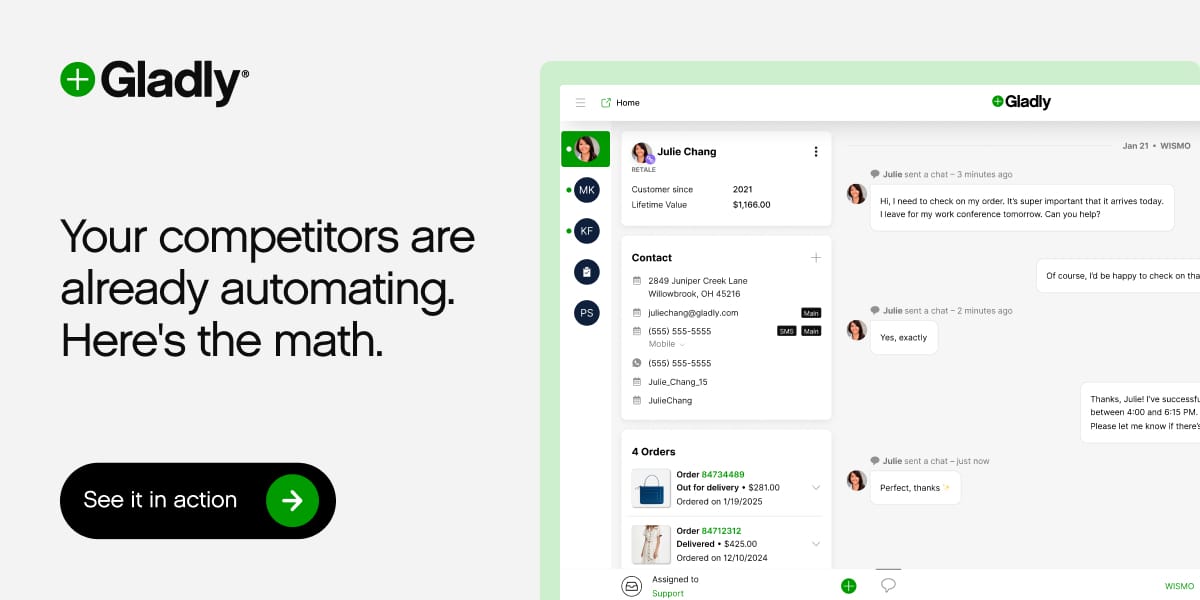

AI that actually handles customer service. Not just chat.

Most AI tools chat. Gladly actually resolves. Returns processed. Tickets routed. Orders tracked. FAQs answered. All while freeing up your team to focus on what matters most — building relationships. See the difference.

⚾️ Catch

We’re running a super short survey to see if our newsletter ads are being noticed. It takes about 20 seconds and there's just a few easy questions.

Your feedback helps us make smarter, better ads.

☝️ Scaled This Past Week: Deepgram

Voice AI startup Deepgram has raised $130 million in Series C – it’s the scale of the week!

With this new funding, the company will expand its presence in Europe and Asia‑Pacific while investing in next‑generation AI models and strategic acquisitions.

Deepgram builds advanced voice artificial intelligence that enables highly accurate speech recognition and real-time understanding for enterprises, powering voice‑driven products and services.

Reply